By Vahid Mansoori and Kataneh Emami

Introduction:

Insurance industry has been stagnant and its growth lagged behind the economy with no substantial improvement in efficiency or profitability. Insurance companies are notorious for being reluctant to adopt change and leverage new technology. The sluggish and stagnant industry however, is now ripe for innovative solutions to address the root causes of decline and inefficiency through defying and disrupting the entire value chain and even business model.

Industry’s income statements since 2008 have been reviewed for further analysis of industry’s growth, efficiency and profitability, and to offer areas for improvement through the innovative utilization of advanced technologies. Sections A to C outline insurance companies’ revenue streams, costs and expenses, as well as financial ratios. If you are already familiar with basics of income statements for insurance companies, you may skip to section D.

A. Revenue

Insurance companies sell their customers coverage (policy) against risk for a price called premium. The premium is invested. Such investments are of course widely regulated, but we do not intend to discuss about regulations in this article. Therefore, insurance carriers have two revenue streams: premium and investment income.

- Gross Premium vs. Net Premium

Many insurance companies share their risk in very different and creative forms. For example, very often they pay a percentage of premium to bigger and higher capitalized insurers (called re-insurers), and re-insurer covers a percentage of losses. An insurance company’s total amount of premiums received is gross premium, of which the re-insurance premium (paid to reinsurance companies) should be deducted to get the net premium amount. Net premium gauges the amount of risk that the insurance company is taking on.

- Net Premium Written vs. Net Premium Earned

Imagine that the insurance company sold a home insurance policy for the total amount (premium) of $1200 for 2017 in January. This is their net premium written. But, they cannot consider the whole 1200 as their revenue yet. In fact, every month, $100 of the total can be ‘realized’ as their revenue. So, at the end of 2017, the total $1200 becomes their “earned” revenue.

B. Losses and Expenses

Insurance companies have two main categories of costs, which include losses and other expenses. Other expenses are usually costs of salaries, underwriting, marketing, sales and administration. But losses should be divided further into two categories: loss cost, and loss adjustment expenses. Loss cost is the insurance company’s cost to compensate for damages. Adjustment expenses however, are the losses to handle insurance claims. The simplest example would be a car accident, and when the insured claims damage to their car. The insurance company pays an investigator to make sure the accident really happened, the car is actually damaged, and the amount of loss to the insured is estimated accurately. In this case, the amount of loss paid to the insured is the “loss cost”, and the amount paid to the investigator is the loss adjustment expense (aka LAE).

Now knowing that total revenue minus total costs and expenses equals profit (gains or net earning), it can be easily deducted that the lesser the losses and expenses are, the higher the profit would be. The reality is, very often insurance companies return losses and are not profitable. It means that by its nature in the insurance industry, expenses and losses are higher than revenue.

C. Ratios

For better understanding and analysis, we need to calculate four ratios:

a) Loss ratio: percentage of loss cost, paid out to compensate damage, plus loss adjustment expenses, paid out to handle claims, divided by (earned) revenue from premiums.

b) Expense ratio:percentage of other expenses divided by (earned) revenue from net premiums. High expense ratio is a sign of inefficiency in company’s operation and business processes.

c) Dividend ratio: percentage of dividend paid out to policyholders divided by earned revenue from premiums. This is mainly applicable to mutual insurance companies.

d) Combined ratio: percentage of loss cost plus expenses plus dividends divided by earned revenue from net premiums. The higher this ratio is, the less profitable the insurance has been.

D. Trend since 2008

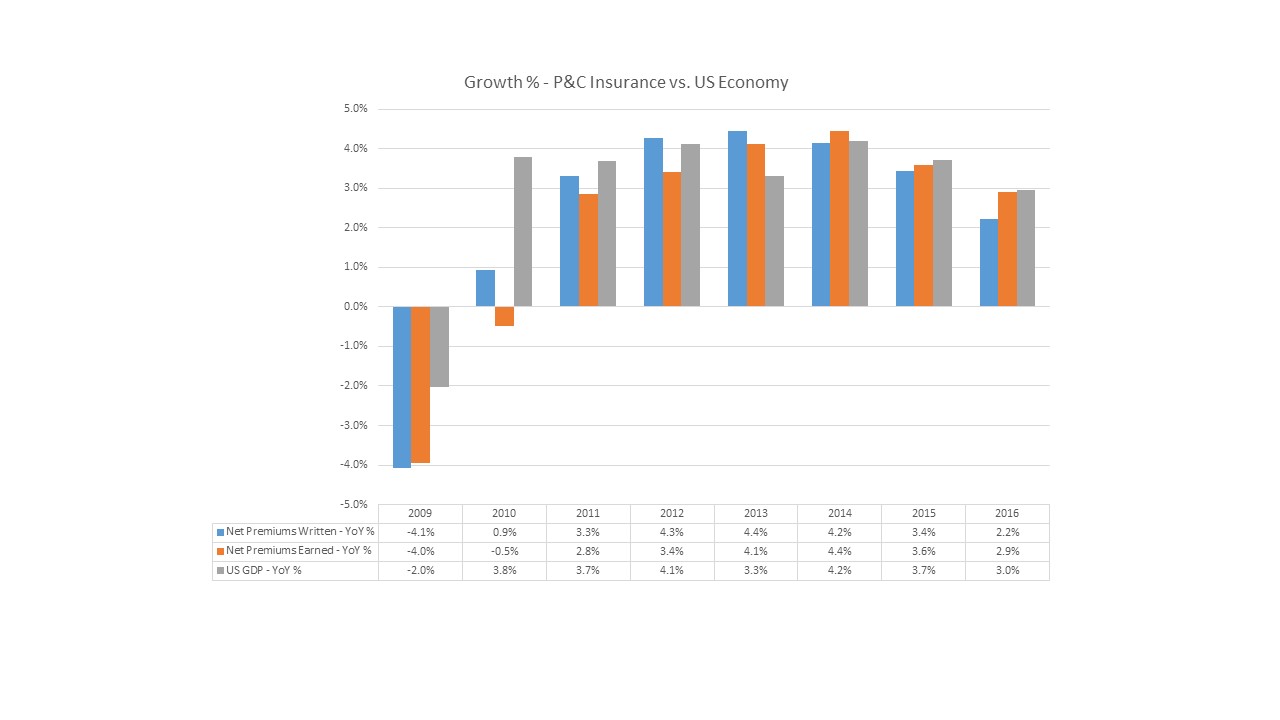

The first chart compares growth in P&C insurance with US percentage growth in total gross domestic products since 2008. From the chart, it is obvious that growth in insurance has been lower than the national growth. In fact, the US economy grew by over 26% from $14.718 trillion in 2008 to $18.569 trillion in 2016, while P&C insurance net written premiums grew by 19.9% and net premiums earned grew by 17.8% only.[1][2][3]

Chart 1 – US P&C Insurance Growth vs. US Economy – 2008 to 2016

Chart 1 – US P&C Insurance Growth vs. US Economy – 2008 to 2016

(Rates are calculated as year over year growth percentage in the dollar value of US total gross domestic product [3][5] vs revenue generated in P&C insurance industry. [1][2])

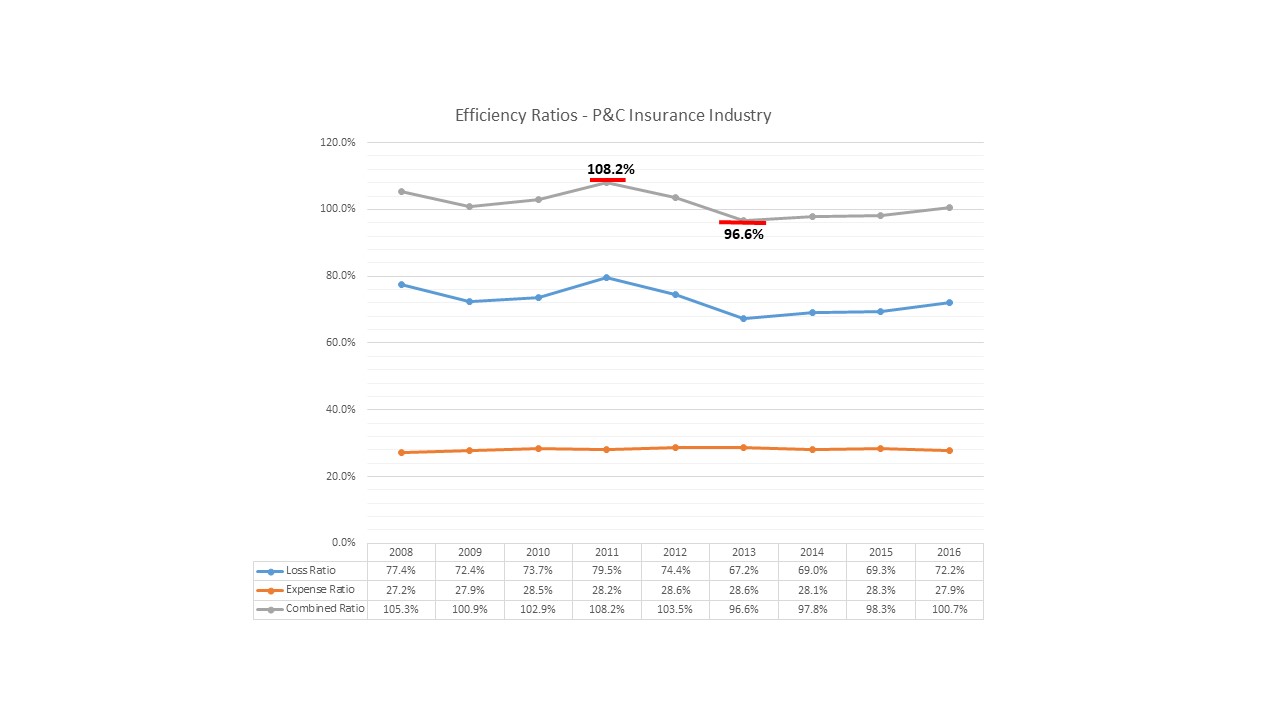

The second chart depicts the very fact that insurance companies usually operate at a loss. In fact, in only three out of 9 years the industry was (marginally) profitable. Insurance industry is known to turn losses by nature.

Chart 2 – US P&C Efficiency and Profitability Ratios – 2008 to 2016

Chart 2 – US P&C Efficiency and Profitability Ratios – 2008 to 2016

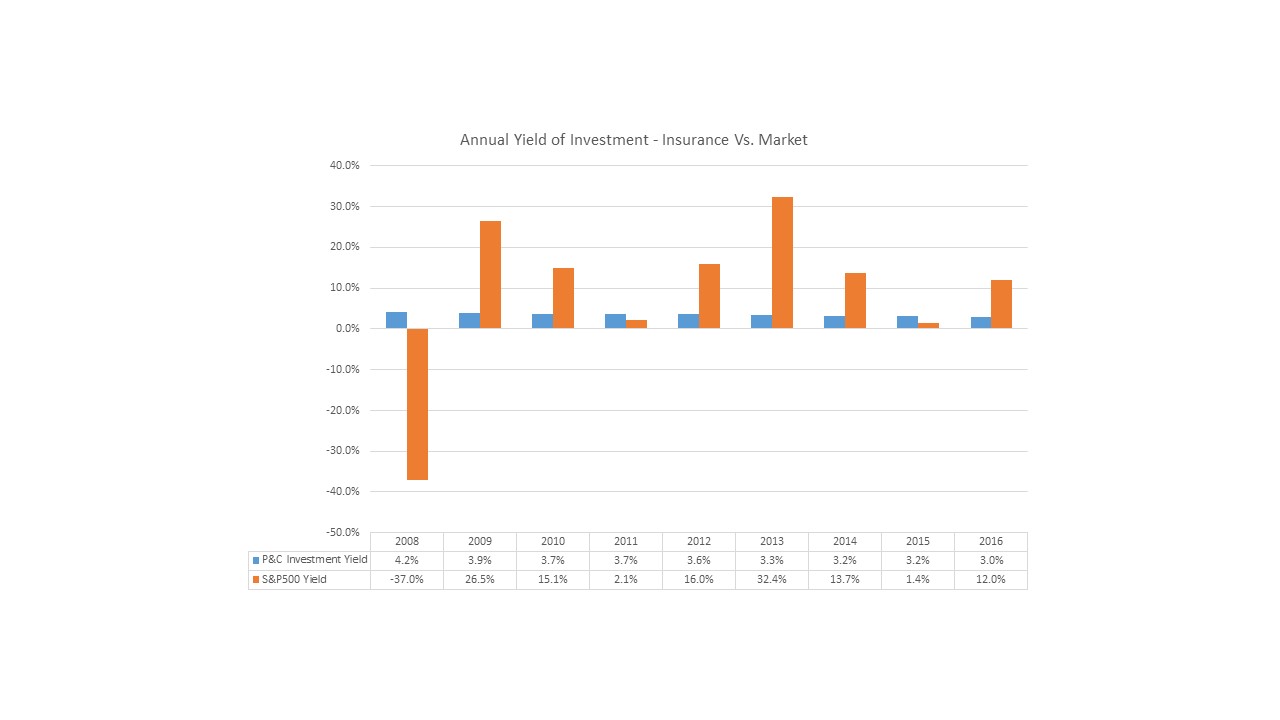

Last but not least is P&C insurance companies yield on investment compared to US market return.

Insurance companies percentage of return on investment has been very reliable with no volatility. But of course, returns underperformed market by a high percentage. In fact, the investment strategy (often because of strong regulation) is to avoid risk at all costs and preserve the capital.[1][2][4]

Chart 3 – Annual Yield on Investment P&C vs. US Market – 2008 to 2016

E. Conclusion:

Historical data shows that growth in P&C insurance is lagging behind growth in the economy. A full analysis of the root causes is out of the scope of this article. At a high level, there are two ways to increase revenue: a) sell more to the existing customers, or b) sell to more customers. In other words the industry should identify, target and reach the under-insured market, and/or identify the new areas of risk and target to underwrite and design products for early market penetration.

There is not much that insurance industry can do to decrease their loss cost which has historically been between 65 to 75 percent. After all, this is the reason of their existence. However, it can be argued that by leveraging advanced technologies like AI, data science, machine learning and IoT, insurance companies can predict the loss, encourage safe and preventative behavior, dynamically price the risks and rein in leakage and fraud related costs to reduce the loss cost ratio.

Subsequently, adjustment cost can be managed more efficiently with newer technologies. AI based image processing, loss assessment using drones and remote sensing and automation are all being explored in this regard and new startups are looking at leveraging all these new technologies to make it easier and more efficient to serve claims.

Cost of revenue (agent fees, marketing and advertisement) can be reduced by effective digital strategies, implementing direct sales channels, and software modernization.

Finally, with the advent of Fintech, highly available data, and the unprecedented possibilities of analyzing data and forecasting the future, insurance industry should be able to adopt dynamic investment strategy. It is absolutely true that the capital collected in premium MUST BE available immediately and as catastrophe hits, but with the very advanced technology, data modelling and analysis methods, soon it should be invest based on market conditions and insurers’ risk profile to optimize (not necessarily maximize) return rather than just preserve the capital.

References:

[1] Source: NAIC, National Association of Insurance Commissioners, Industry Snapshots, Dec. 31, 2012

[2] Source: NAIC, National Association of Insurance Commissioners, Industry Snapshots, Dec. 31, 2016

[3] https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=US

[4] https://ycharts.com/indicators/sandp_500_total_return_annual

[5]

|

2016 |

2015 |

2014 |

2013 |

2012 |

2011 |

2010 |

2009 |

2008 |

| US Gross Domestic Product (in million $) |

18,569,100.00 |

18,036,600.00 |

17,393,100.00 |

16,691,500.00 |

16,155,300.00 |

15,517,900.00 |

14,964,400.00 |

14,418,700.00 |

14,718,600.00 |

| Change % [(y2-y1)/y1] |

2.95% |

3.70% |

4.20% |

3.32% |

4.11% |

3.70% |

3.78% |

-2.04% |

|